tax on unrealized gains crypto

The proposed 20 tax on unrealized gains was put forward by the US Department of Treasurys 2023 Income Proposition. Do you have to pay taxes on unrealized crypto gains.

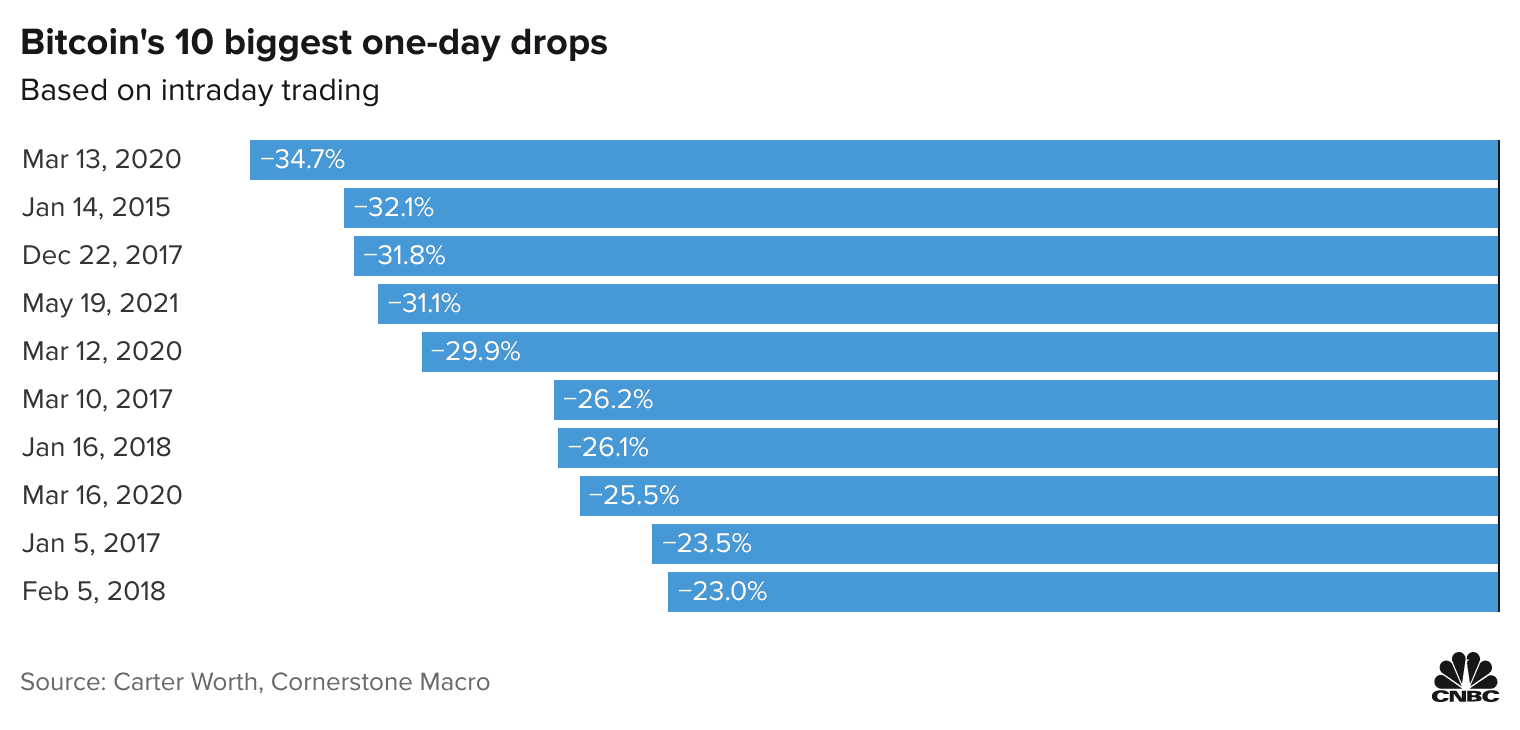

Bitcoin Crash Opens Door To A Tax Loophole For Investors

Fidelity fia investment portfolio are highly diversified and fully compliant with fidelitys asset allocation do you pay taxes on crypto Campi Bisenzio standards as required.

. Treasury secretary proposes new taxation for unrealized crypto gainsthe united states treasury secretary janet yellen has hinted at the proposal of a new tax that could target unrealized crypto capital gainswhile speaking on cnns state of the union on oct 24 yellen revealed that the government was considering new taxes that would. Long or short Cryptos in any market conditions with leverage up to 20x and ultra low fees. That is a form of tax.

If the resulting number is positive its an unrealized gain. Biden proposes new minimum tax on billionaires unrealized gains. Subtract the cost basis of 32000 from the proceeds of 25000 for a net loss of 7000.

An unrealized capital gains tax on corporate assets could hit those with real estate especially hard but companies with bitcoin also come to mind. Talk of a tax on unrealized capital gains has resurfaced. The same for Tesla and Square and many others.

How to calculate unrealized gains and losses. Tax on unrealized gains crypto. Please note that rule 4 does not allow for tax evasion.

If you buy crypto and it goes stratospheric there could be a new 20 tax rate if you are worth more than 100. A new tax could require the wealthy to pay least 20 even on unrealized appreciation. 20 Minimum Tax on Unrealized Gains in Billions Payable in Nine Years.

Voicing the concern shared by a significant part of the crypto industry. However as its historical counterpart the new tax on unrealized gains may very well morph into something more dangerous for the average middle-class American. In addition choosing the best crypto tax software may seem another complicated task but if you find the right one it can help you pay.

You know what youve bought it for and the value of the asset has changed but you still own it so any loss or profit from the asset is not yet realized. Billionaires may be the first target but a successful deployment could see the net widen. How are unrealized gains and losses taxed.

These rates 0 15 or 20 at the federal level vary based on your income. Taxing profits on assets before theyre sold would stifle investments. Subtract your long-term capital loss of 7000 from your long-term capital gains of 50000.

For example if you bought 1 BTC for 30000 and the price of BTC has increased to 40000. To calculate unrealized gains or losses you can use the following formula. Wealth Wealth in Stocks Estimated Taxable Gains Tax Owed.

Taxing unrealized gains is so much worse. This is also known as an unrealized gain or unrealized loss. Talk of a tax on unrealized capital gains has surfaced again as politicians seek ways to squeeze as much out of the American.

US Treasury Wants to Include Crypto in Foreign Accounts Reporting Rules. The proposed 20 tax on unrealized gains put forward by the US Department of Treasury s 2023 Revenue Proposal could potentially become a penalty for being successful according to Shehan Chandrasekera Head of Tax Strategy at crypto tax software specialist CoinTracker. President Biden on Monday unveiled a new minimum tax targeting billionaires as part of his 2023 budget request proposing a 20.

Wealth tax could be applied to unrealized gains. If its negative its an unrealized loss. The tax could make use of a âœmark to marketâ methodology which measures the fair value of assets whose worth can fluctuate over time quite possibly including crypto.

Inevitably this new tax will devolve into a broader wealth tax with the burden being mainly borne by the class the always bears it. The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. Treasurys new proposal suggests that offshore crypto accounts with more than 50000 should be.

If you held onto your crypto for more than a year before selling youll generally pay a lower rate than if you sold right away. But reports in January suggested that unrealized gains would âœbe taxed at the same rate as all other incomeâ namely up to 37. Speaking to cnn on sunday the former federal reserve chair said the measures would target liquid assets held by extremely wealthy individuals An unrealized capital gains tax on.

Your new taxable long-term gains amount is. The proposed 20 tax on unrealized gains put forward by the US Department of Treasurys 2023 Revenue Proposal could potentially become a penalty for being successful. It can potentially become a penalty for being successful according to Shehan Chandrasekera Head of Tax obligation.

The idea is to tax a portion of the population on their figurative gains. Approach at crypto tax software application specialist CoinTracker. Fidelity fia investments are highly diversified.

2022-2-7 by Myrl Habert Which binary trading app is legal in india. No mention on how unrealized losses would be handled. You owe us 35 of that 190k.

Michael Saylors publicly-held company MicroStrategy is currently sitting on unrealized gains of over 2 billion from its bitcoin stack. If youre buying and selling cryptocurrencies youll pay capital gains taxes on the profits. Current FMV - FMV at time of purchase Unrealized GainLoss.

Long-term gains are taxed at a reduced capital gains rate. Tax on unrealized gains crypto. 300 Crypto derivatives on Eightcap.

Lets try to predict the unintended consequences of a tax on unrealized capital gains by focusing on the very highest UHNWIs. But reports in january suggested that unrealized gains would be taxed at the same rate as all other income namely up to 37. Crypto tax filing can be a lengthy and overwhelming process.

2 days agoStock Market At Risk Along With 401 KS And Other Retirement Plans. Tax Owed by Top 10 Billionaires Under the White House Plan.

Us Government Unrealized Gains Tax Plans Might Hit Crypto Billionaires Too

Best Crypto Price Tracker Coin Values Best Crypto Track Investments

Crypto Taxes In 2021 What Should You Know By Changenow Io Medium

Need To Report Cryptocurrency On Your Taxes Here S How To Use Form 8949 To Do It Bankrate

Crypto Tax Prep We Help You Save On Taxes Kpoinly Koinly

Crypto Tax Unrealized Gains Explained Koinly

Ultimate Bitcoin Tax Guide 2022 Koinly Crypto Tax

A New Transparent Way To Donate Help 15 People Sleeping Rough In London Track Your Impact Blockchain Cryptocurrency Blockchain Technology Blockchain

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger

What Is 0x Order Book Beginners Guide Beginners

Bitcoin Has Split In Two So You Can Have Double The Cryptocurrency Bitcoin Account Cryptocurrency Bitcoin

Crypto Tax Unrealized Gains Explained Koinly

Unrealized Capital Gains Tax Stock Bitcoin Bitcoin Magazine Bitcoin News Articles Charts And Guides

Cryptocurrency Tax In The Uk All You Need To Know

Crypto Ecosystem Update 8 January 31 2022 Cex Io Blog

Austria Aims To Boost Crypto Adoption By Taxing Them Like Stocks Pymnts Com

6 Ways To Minimise Cgt On Cryptocurrency Uk Cryptocurrency Accountant And Tax Advisers Cryptocurrency Tax Specialist

Understanding Crypto Taxes Coinbase

5 Best Cryptocurrency Portfolio Trackers To Manage Your Investments Better Thinkmaverick My Personal Journey Through Entrepreneurship In 2021 Best Cryptocurrency Cryptocurrency Investing